-

Prevent Casino Fraud & Counterfeit Money

Operators Seek to Reduce High Levels of Casino Fraud

Complex Financial Regulatory Requirements Define the IndustryIn today’s casino gaming market, business operations are complicated by conflicting needs. On one hand, operators wish to defend their organizations against casino fraud and comply with state and federal regulations requiring strict identity & age verification procedures; on the other hand, customer service is the ultimate factor determining if the casino property sinks or swims, so each patron needs to be welcomed and treated properly. The challenge is to achieve balance.

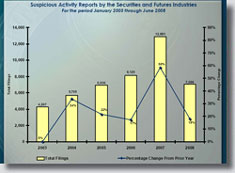

The Gaming Industry has long been a hotbed of fraudulent activity. Casino fraud has steadily increased over recent years, as the table to the right, showing Suspicious Activity Report filings (SAR’s), indicates.

Source: FinCEN SAR Activity ReviewCasino Vulnerabilities

Due to the very nature of the gaming industry, locations can be exposed to a variety of different fraudulent crimes. Counterfeit money, fake credit cards, phony checks, and applications for credit using stolen identification are all common occurrences in gaming establishments. Many of the larger players in the industry which operate highly complex businesses - involving restaurant, bar, nightclub, retail, hotel, and theme park operations, in addition to gaming - find that managing exposure to fraud to be labor intensive and inaccurate, thereby multiplying their exposure to regulatory scrutiny.

Comprehensive Fraud Prevention Empowers Compliance Initiatives

Fraud Fighter™, the leading provider of counterfeit fraud prevention equipment, has solutions that help the gaming industry strike the right balance between customer service and internal controls. An evaluation of operations is conducted to identify the type and nature of exposure to both transactional fraud as well as to issues involving regulatory compliance. For example, in many locations, the requirements of Title 31 of the Bank Secrecy Act may mean that the ability to authenticate identification is needed, while in other locations it may be sufficient to simply validate the ID document.

-

Derived from the risk assessment, a “layered solution” approach is then recommended which matches different types of equipment to different areas of the operation. The goal is to provide complete coverage against fraudulent transactions, only placing “high end” equipment capable of performing more complex identity verification tasks in those locations where exposure to high–dollar fraud is justified, or where state or federal guidelines suggest it may be required.

Added Value: HR Protocols and compliance

In addition to fraud prevention and financial transaction compliance issues, Fraud Fighter™ product solutions provide Human Resource departments with proven tools that contribute to reliable applicant screenings during the new hire process. For medium and enterprise operations that have high–level employee “churn” and are constantly involved in hiring new employees, Fraud Fighter empowers firms with rapid document authentication & identity validation solutions at optional levels of cost and accuracy.

Fraud Fighter’s advanced screening capabilities are critical in a broad applicant base hiring process, particularly as it relates to adhering to Immigration and Nationality Act (INA) employment eligibility verification requirements.